There are a huge number of possible use-cases for machine learning and AI in the telecoms industry, from underpinning the natural language processing which underpins the chatbots that answer billing queries to optimising the placement of engineers and their equipment and handling the distribution of virtualised resources.

It is also being used to help identify coverage holes – Dean Bubley, founder and director at Disruptive Analysis, recalls being shown by one operator how it had used “image recognition to look at areas of the country where there are dwellings or buildings and then matched that to what their network was telling them in terms of usage, and from that they could infer where they had coverage gaps, perhaps due to trees or topography”.

If we drop down to a more granular perspective, according to Derek Long, head of telecoms and mobile at Cambridge Consultants, “there is a significant amount of work being done to characterise the electromagnetic environment and therefore [to] be able to use channels that have lower interference, thereby improving quality of service”. He adds that it is also being used to underpin the working of phased arrays and beam steering.

Ascending once more to the macro-network level, Bradley Mead, head of network managed services at Ericsson, says “the key and exciting part about this” is the fact that while in today’s network operations centres many high-volume activities are already automated, they are still dealing with issues in a reactive manner – “everything’s incident-driven” – and that in addition to allowing the expected increase in complexity, machine learning “allows us to shift to be able to predict things before they break”, thereby boosting networks’ reliability and consistency and thereby improving the end-user experience and reducing customer complaints.

Slicing at scale

One other big theme is the way in which network complexity is increasing to the point where human minds alone will not suffice.

“Networks are going to become complex with more nodes and also the volume of traffic will continue to grow exponentially,” says Mead. He notes the way in which 5G will enable network operators to create network slices which they can then use to differentiate services and customer experiences. While “that’s really exciting, it’s a new level of complexity; [but] it doesn’t scale by just adding more people, so you need machine learning and automation just to handle [the] complexity..”

“It’s been hard for humans to plan and optimise telecom networks without assistance for some time, and it’s going to become increasingly complex, so it’s clear where AI can add value,” adds Long.

Mead says humans will still be needed but their skillset “will be much more high-end, they’ll be there to tune the algorithms as the networks evolve over time and [handle the] lifecycle management of these [systems], as well as being there to handle the more complex issues that often arise in networks”.

Bubley says that if network slices/virtual networks are limited in number and relatively static then it might be possible for these to be monitored and configured by people, but if 100-1,000,000 slices are being run over the same network, “you will need to have heavy-duty automation. [The] vision of the future where every application developer buys a slice from the operator can only work if you’ve got very intelligent control software that is trying to juggle [everything], and at that point the algorithm for doing the resource allocation and management and dealing with any problems that arise potentially becomes a single point of failure, [and] that’s where there are concerns – ‘do I want to have one software system running everything and also potentially acting as a black box because it’s learned from whatever inputs it’s got?’.”

Long adds that Cambridge Consultants is working to address these concerns and has developed transparent and auditable machine learning algorithms. “We’ve developed the AI and optimised the silicon to run machine learning on ultra-low-power edge devices.”

But what about the issues that have to be addressed if the industry is to realise its full potential? Long believes that structuring and curating the data on which the algorithms are trained is the number-one issue, particularly given that this process is “repetitive and time-consuming”, yet has to be done by “highly trained experts” – data scientists or engineers with experience in and knowledge of developing AI algorithms. He notes that there are some applications in telecommunications where there is very little data to start with – particularly in the provisioning of services. However, he adds that Cambridge Consultants has developed unsupervised deep learning techniques, which can train on vastly reduced data, in some cases just a few thousand entries, rather than the hundreds of thousands that are typically required, lowering the barrier to adoption and making it more feasible to leverage within the network.

Rare as hen’s teeth

The next biggest problem that Long sees is “the lack of people with knowledge over both AI and telecommunications”, given that creating algorithms to detect abnormal behaviour on a network requires someone who knows what abnormal behaviour looks like, while also being able to train the algorithm. Similarly, Ericsson’s Mead says knowledge of telecoms and end-to-end management of networks is critical when generating use-cases, developing algorithms and creating the automated routines that allow systems to carry out actions based on the insights or predictions generated by the algorithms. He adds that his company’s approach is very use-case-driven – it is working with a number of its key customers to determine the use-cases that they feel it should invest in (those that they expect to deliver the most value) – and then the company will roll these out across its broader customer base. “Taking this approach [will ultimately allow us to move faster] than trying to work on too many things at once.”

Bubley adds that “high-end machine learning, deep learning engineers are as rare as hen’s teeth and more expensive than plutonium. There’s a reason why Google, Amazon and Uber hire as many people straight out of universities as they can and it’s not obvious that many in the telecoms or wireless industry [will] necessarily be [the] number-one target for the most talented people.”

However, Mead says over the past 18-24 months, Ericsson has been developing people with the necessary skills – both by bringing in data scientists/engineers and training them in domain-specific skills, and training existing staff in data science/engineering. “We have more than 400 people multi-skilled in these areas, just on the network and server side.”

Similarly, Long says Cambridge Consultants’ AI team is “an evolution of our DSP (digital signal processing) group, as the algorithms that are used for AI are very similar to DSP”.

Fear the FAANGS?

Given the competition with Silicon Valley for talent, combined with the latter’s expertise and investment in AI, it is worth asking if the need for AI could be a way for the FAANGs (Facebook, Apple, Amazon, Netflix and Google) to capture some of the value. “They have huge financial muscle and they’re very innovative and agile,” says Long. “Do they pose a threat to the telecommunications industry? Absolutely they do. Think about public cloud providers, such as AWS, as the operators of the future. They provide easy-to-use APIs, are very familiar with Devops and agile methods of software and functional development, are very enterprise-focused and don’t have to bother with the legacy of connecting people with each other – let the wireline and mobile operators do that. They really focus on providing value to their customers in an efficient and optimal manner.”

However, as Ericsson’s Mead has already pointed out, considerable “domain expertise” is required, both to train the algorithms and create the processes that allow networks to react to the predictions they make. In addition, Simon Fletcher, Real Wireless’s CTO, adds that “even if the development capability is not within the operators, it [doesn’t] preclude the operator from accessing that capability through a service that is provided by an AI specialist house; it may be Google or someone else, it doesn’t necessarily have to be developed in-house. So, the staff within the operators, they need to understand how to configure the AI, how to work alongside it, but the [machine-learning intellectual property] and the algorithms could be owned by a third party.”

He also notes that given the “great percentage” of traffic that goes over mobile networks from YouTube and the demands it places on them, it might motivate [video content platforms] to “provide an AI service that helps provision that video service over networks and it could be that they can offer something in the cloud or even at the edge”.

Fletcher also highlights the risks from disruptive new operators. “Rakuten [in Japan] have been around for many years as a retail brand and offer a lot of digital services in that vertical. They’ve announced they want to build their own cloud-based networks and in effect become a fourth operator competing with the likes of [NTT] Docomo [and KDDI-owned au]. It has a different cost-base model and a lot of it is [based on] software and [automation which] reduces operational expenses. That disruptive model may be enabled by having some smarts in the network which are machine-learning and AI-orientated.”

He adds that the desire within established MNOs to adopt disruptive approaches, and the speed at which they can, is not clear, and that “could be one of the interesting challenging points”. Fletcher says this ties into the way MNOs are seeking to target verticals with 5G, and new disruptive players might be more aggressive in this regard.

Machine learning and AI look set to improve the reliability of telecoms networks while allowing their operators to cope with all the increased complexity that 5G will bring, in terms of planning, management, and the orchestration of slices. That said, it’s clear that we are moving into a very different world – one in which the willingness and ability to transform business models and practices at speed may become just as important as the technology they rely on, especially given the extent to which vendors are focusing on quickly exploiting machine learning’s potential.

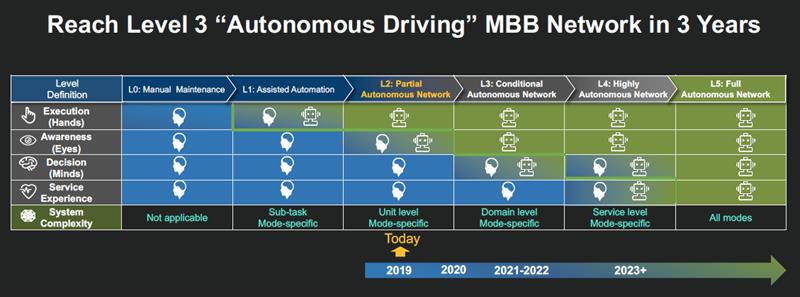

Huawei has set itself the challenging target of reaching what it describes as Level 3 autonomous driving (partially autonomous domain-level, mode-specific)in three years’ time); this will be capable of sensing real-time environmental changes, and in certain domains optimising and adjusting itself to the environment, enabling intent-based, closed-loop management

Energy matters

One application of machine learning is enhancing energy efficiency. Real Wireless’s Fletcher notes that at the macro-level, “there are techniques you could employ to reduce a network’s [energy] consumption [by] switching nodes off in the network; they are not [currently] widely deployed because if you switch off a radiating cell, then you need to replan the network”. He adds that doing this is complex. “You’re going to need machine intelligence.”

Adjusting network capacity and therefore power consumption to traffic load is a tried-and-tested method. One issue with this approach is that it might be incompatible with the requirements of mission-critical users and the users of network slices. “Where connectivity is required, the underlying physical network has to support that service,” says Cambridge Consultants’ Long.

Ericsson’s Mead says “we’ve trialled [a use-case] with one customer in Asia that allows us to predict, based on historic data and data from the power grid, when a power outage is likely, and also to predict, if it did occur, do the batteries have enough, will they last long enough?”.

Savings can also be made at the hardware level. Back in February, a Huawei spokesperson said up to 15 per cent power saving per base station from embedded machine learning is achievable. The company also claims that 30 per cent energy savings are possible when this is used in combination with its management and control engine.