One of the key messages from the Small Cells World Summit, which took place on 21-22 May in London, was the stark difference between the pace at which the underlying technology is being developed and the current speed at which it can be deployed at scale. While the vendor community was there in force, emphasising the innovation that has gone into its latest wares, Gavin Jones, MD mobile operator, media and broadcast divisions at BT Wholesale, (pictured above) highlighted the “gap between expectation and delivery”, noting that this year his division’s fastest deployment of small cells was 22 days, its average was 52 and its slowest was 140 days (up from 90 last year).

“This is really tricky work – councils, power, roadworks… access to concessions [and] assets [all make] this incredibly difficult. The gritty reality [is] that the technology is brilliant, but the reality of deploying [small cells] in the thousands [to meet the demand that 5G is going to create] is going to be really tough, so we are definitely going to have to change the way we operate [and] improve.”

He used a simple calculation to demonstrate the scale of the problem: assuming that 770,000 small cells will be installed in the UK between now and 2025 (based on a market status report published in December), each requiring 44 hours of touch time to install, 3,160 workers would be needed; but with an average lead time of 100 days, it would take 210,959 years to satisfy the demand by deploying the small cells in a serial fashion.

Jones went on to list a number of areas that need to be addressed, including reducing total cost of ownership, access to assets and encouraging operators to share assets – “we are trying to get as many operators on the same infrastructure on a virtual shared basis as possible – we believe that’s the key to success”. However, he believes the most important area to focus on is neutral hosting for indoor small cells.

Jones also struck a number of positive notes, saying that the performance of some of BT Wholesale’s small cell deployments have impressed mobile network operators (MNOs) and exceeded their expectations. “They started looking at them for density, they’re now looking at them for coverage.” He also said at “some of the sites we’re seeing throughput of up to 100Gbps”, and they are “drastically” reducing congestion on macro cell sites and improving the customer experience.

“We’ve done more in the last 12 months than we’ve done in the last six years altogether. The road is genuinely opening up, technology and innovation has a massive role to play [and] I’d like to be the first to say that small cells are genuinely here,” he concluded.

Growing pains

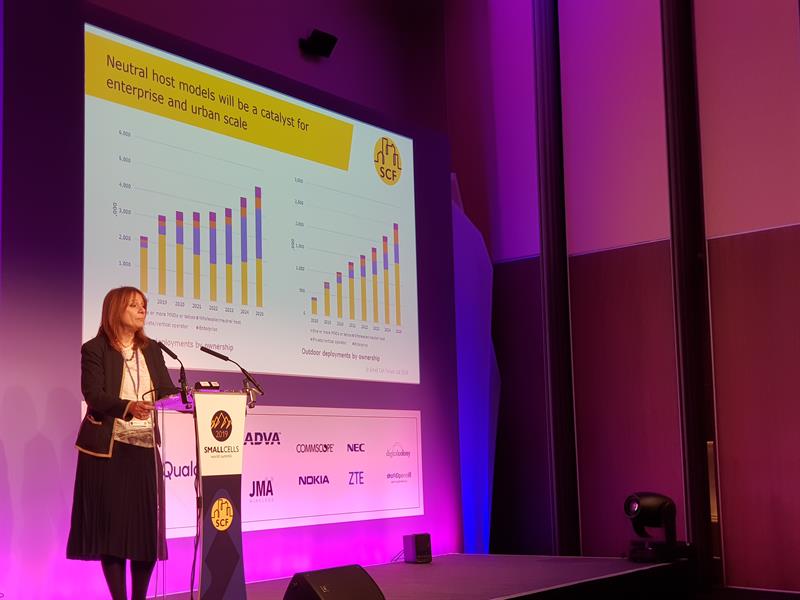

Rethink Research’s Caroline Gabriel (pictured below) then gave an update on the state of the densification market, highlighting some of the statistics from the Small Cell Forum’s latest Market Status Report (prepared by her company) and explaining their significance and the underlying methodology. The topline figure is that worldwide annual small cell deployments are expected to grow at a compound annual growth rate of 13 per cent between 2018 and 2025 – each small cell unit referring to a radio head, as in some cases multiple units may share one baseband – with enterprise (mostly indoor) and urban deployments being the main “growth engines”. Particularly with the former, Rethink is predicting there will be two main phases of growth; the “big uptick over the last couple of years – most of that is driven by 4G… we then see deployers stopping and thinking a bit as they prepare to make choices about how or when they migrate to 5G, and then you see a second growth kicking in from 2022, 2023, and that is really 5G-driven”. Gabriel expects 4G deployments will continue well into the 5G era and that the extent of this overlap will be bigger than that seen in macro cells. “This makes some of the virtualised architectures particularly important.”

Shifting specifically to indoor coverage, she said “any analysis of 5G says while operators will initially usually deploy 5G to enhance services for their traditional customer bases in mobile broadband, to really justify the investment in 5G and small cells there will need to be entirely new revenue streams, and most of those will be coming from enterprise, industrial and IoT environments, and many of those enterprise and industrial use-cases will only be effectively supported if we have full deep penetration indoors”.

Gabriel then reeled off a number of factors identified by MNOs and other operators that if addressed could accelerate small-cell roll-out including operating costs, ease of deployment (a shift to plug-and-play), and a clear framework for cost/risk sharing between operator and enterprise. She explained that if all these factors “are well addressed over the coming years, an additional 1.5 million indoor small cells would be deployed in 2025 compared with the baseline forecast (and two million more than the worst case).

Returning to the new use-cases and services that 5G is expected to support, such as IoT and critical communications, she said: “The key is that each individual use-case is unlikely to generate an exciting business case for an operator, it would be very incremental. What they really require is a flexible generic platform that can easily be tailored and in the future sliced to support many different specialised use-cases, and then each of those incremental revenue streams adds up to something very significant. Many of these require small cells and also edge computing to get processing near to the user, to reduce latency, to improve coverage. A platform that combines small cell and edge with good coverage can really transform not just user experience but service diversity, the number of different services that can be supported in an optimised way from one platform. Much of this will be neutral host.”

Indeed, Rethink predicts that by 2025, 60 per cent of indoor small cells will not be deployed or managed by MNOs, while this shift will be slower for their outdoor counterparts – the majority (61 per cent) are predicted to still be installed and run by one or more MNOs in 2025. The report also states that while “traditional monolithic small cells” made up 60 per cent of deployment in 2018, this will drop to 17 per cent by 2025, by which point the dominant architecture will be the virtualised disaggregated network.

The value of collaboration

Dean Bubley, founder and director at Disruptive Analysis, said he is seeing a lot of interest in neutral host at the moment, both for indoor and outdoor locations, although question marks remain around backhaul “and things like that”. He questioned whether “there are enough people who can install 4G and 5G small cells, and where are the training programmes and certification for them?”

Bubley also said he is “sceptical that 4G or 5G is the replacement for Wi-Fi in 99 per cent of cases especially for normal IT and internet access type LAN environments”. He explained that for use-cases in which things are moving around, such as robots, wearables and asset tracking tags, particularly in campus environments, “you can’t use local technologies [like] Wi-Fi and Bluetooth, you need to have something with better ability to handle the mobility and the [transitions between] outdoor and indoor”. He explained that this is more about licensed versus unlicensed spectrum than 5G, and lamented the lack of a version of Wi-Fi that can operate in licensed spectrum.

Dean Bubley (third from the right) questioned – given the expected scale of demand

for small cells – whether there are sufficient trained installers and training programmes

Simon Fletcher, CTO at Real Wireless, initially focused on critical communications and IoT use-cases. “We’ve got to have a fair amount of innovation in looking at how we deliver and it’s clear from the total cost of ownership and other techno-economic analysis that we do for our clients that small cell is an integral part of the proposition.” He also said Real Wireless is seeing a lot of interest and demand – “it’s not just industry push”.

Rethink’s Gabriel drew attention to the way that enterprise and industrial players “generally pay for their own Wi-Fi” but “they’ve traditionally not wanted to pay for cellular, and that’s been a huge barrier. It’s changing slowly.” She added that some markets are very advanced in this regard, highlighting Japan, where enterprises “co-invest even into the macro [network]”.

Fletcher agreed, adding that he had been in Japan the week before the event. “There’s a much stronger partnership, there’s a recognition, it’s out there in the air, everyone recognises the value of the connectivity piece [so they collaborate].”

However, Bubley said: “If you’re going to put [up] the money, you might as well own it, because if you’ve got an industrial company, their cost of capital is probably lower than the telcos.”

Dispelling the mmWave myths

Puneet Sethi, senior director, product management at Qualcomm Atheros, took aim at those who are sceptical about the use of millimetre wave for 5G networks, highlighting his company’s work to commercialise mmWave in smartphone and small cell form factors, as well as other areas of R&D. Qualcomm has performed trials at its office in San Diego to assess mmWave’s indoor performance, in both high- and low-density deployments, simply by co-siting the 5G NR mmWave gNodeB antennas with Wi-Fi access points – “so no need to draw new power cable or backhaul” – and the absence of “any sophisticated RF planning”. In both cases, they achieved 98 per cent downlink and 99 per cent uplink coverage, while the download median burst rate was 5Gbps in the high-density deployment and 4.9Gbps in the low density – “the results actually surprised us”.

Kieron Osmotherly, founder and CEO of TowerXchange, drew attention to the fact that tower companies will and are playing in small-cell roll-outs, and noted they are “typically more highly valued than the MNOs to the tune of three to four times”. This, he explained, gives them access to low-cost capital “and increasingly we’re seeing licensing and regulatory environments around tower companies opening up to explicitly enable them to deploy small cells”. He also said: “We’re on the eve of the 5G roll-out when it comes to hanging kit on towers and we’re poised for an unprecedented period of change in European towers. We’re seeing the pace of newbuild outpace decommissioning, and a lot is going to be urban infrastructure hosting a small cell rather than macro.”

He concluded by saying: “We’re starting to see tower companies and neutral host becoming more and more critical stakeholders in the small cell ecosystem, and they’re going to be the most important customer group for the small cell industry in this continent and others in the very near future.”

Educating cities

At the event, I caught up with the chair of the Small Cell Forum, AT&T’s David Orloff. He highlighted SCF’s regulatory working group, “which is working to remove barriers with municipalities and we’re seeing quite a lot of promise and progress there”. He added that in the US, municipalities are coming to MNOs saying they recognise they require 5G to become advanced cities, which shifts the conversation in the MNOs’ favour, allowing them to highlight the need for regulatory regimes around small cell deployments to be cost-effective, “as opposed to the municipalities just saying ‘[we] want to charge you [a huge amount of money] for each pole’”.

Orloff added that SCF is applying its experience in the US in this regard to Europe –“We’ve been working to date at the [European] level [through contributing to the Global5G.org study for the European Commission’s Communication Committee (COCOM)] and we’ve been successful there, so now we need to... [educate and influence at the] municipality level, so once the operators in Europe are ready to go, it’s easier [for them]”.

While the small cell industry has some way still to go before all the issues have been addressed and it can enjoy unfettered growth, the barriers are well known and it is to be hoped that the combination of neutral hosting, greater clarity over 5G business models and use-cases, and the widespread civic desire to be leading the charge on digitisation, will help smash them asunder.